The HumpThis website was created to make suggestions on how the government might fix the problems with the current Social Security system, but we all know what chance we have of the government doing something logical that might be good for the country. Re-election is their primary goal. So, since we have to live with the current system, for a while at least, these pages were created to help us avoid one of the biggest problem that some of us will face, retirees paying the highest taxation levels of any American citizen, something we call The Hump. A little disclaimerThese spreadsheets are here just to give you an idea of what you should consider when planning your tax strategies for retirement. They represent only the federal taxes for 2011. They do not include any state or local taxes. I’m not an accountant or investment manager. You should get the help of a professional to do your actual planning and use what you learn here as talking points during that planning. The SpreadsheetsYou can download copies of the married spreadsheet and single spreadsheet by right clicking on the links and saving the XLSX files to your hard drive. The right click option in Explorer is "Save Target As...", and in FireFox the option is is "Save Link As...". These guys will do anything not to be the same! Spreadsheet BasicsThe only boxes you will modify on the spreadsheet are the column of green boxes near the top of the spreadsheet. Remember when you were told not to play with the yellow snow? Well, don’t play with the yellow boxes on the spreadsheets! These values are calculated from the entries you make in the Green boxes. If you modify them you will break the calculator. The spreadsheets are divided into 4 basic parts.

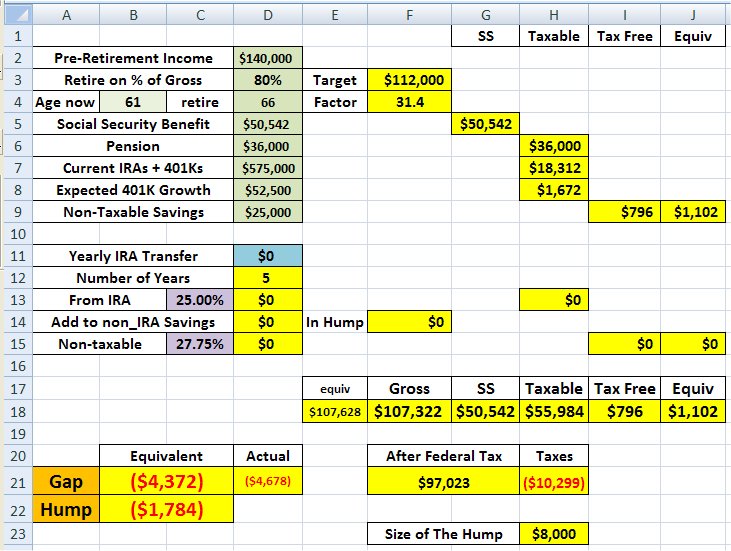

An ExampleJohn and Mary are both 61 and would like to retire at age 66 on 80% of their current income. They currently make a total of $140,000 and their jobs offer them a small pension and 401K benefits with a company match of 50 cents on the dollar for the first 5% of salary they contribute. They each contribute 5% to get the maximum company match; a total annual contribution of $10,500 which is $7,000 from their contributions plus $3,500 from their employer. The combined value of all of their IRAs and 401Ks is $575,000 and they have a non-IRA brokerage account of $25,000. They have checked their annual Social security benefits statements and their combined expected benefit at age 66 will be $50,542. They fill in their financial numbers in the Green section of the spreadsheet (D2-D9) and their age (B4). The chart uses a withdraw factor (F4) based on their retirement age. This factor is an extension of the government's minimum IRA withdraw requirements.

The chart tells them (BC21) that they will be $4,372 short of the income from savings necessary to generate the desired 80% gross income level. They decide to see what working another year will do to their retirement income. They change the retirement age, social security, pension, and 401K growth values to reflect the additional year of work.

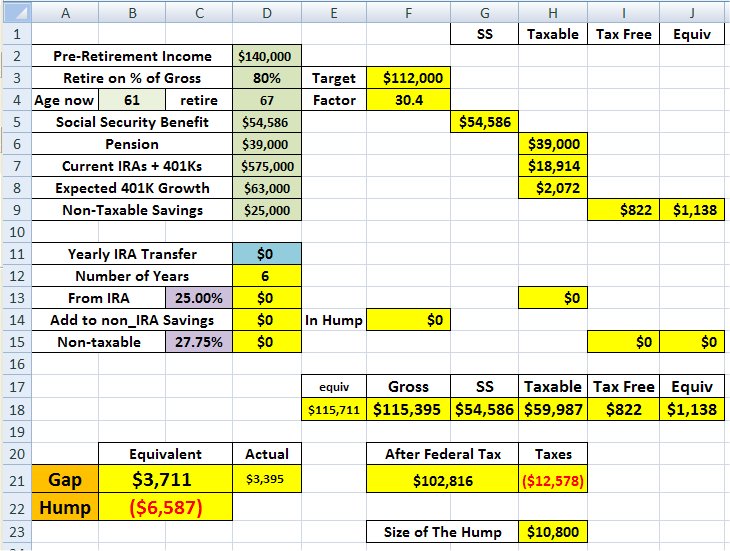

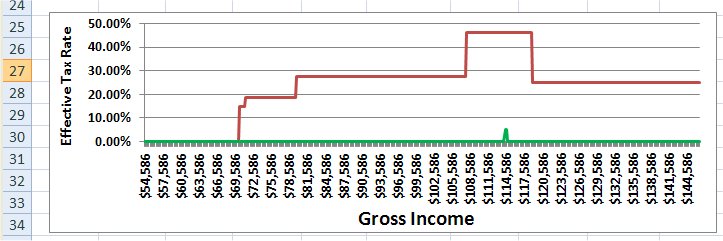

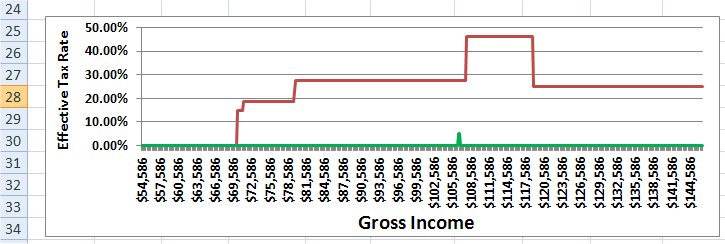

Now they will have an additional $3,711 (BC21) of spendable cash each year, but they are also "In The Hump" by $6,587 (BC22). The small green tick mark at the bottom of the chart also illustrates where they are within The Hump.

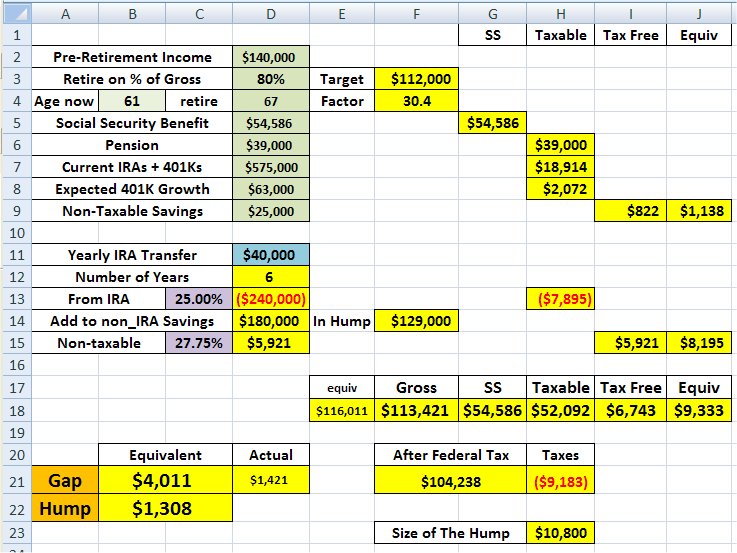

They check back tax returns and find that their normal taxable income each year is a little over $95,000. The top limit for the 25% tax bracket is $139,350. Since they are over 59½ they can withdraw money from their IRAs without paying the 10% penalty for early withdraw and only pay their normal income tax on the withdraw. Since it is better to pay 25% now then it would be to pay 46.25% during retirement, they decide to withdraw $40,000 each year until they retire and save the after tax money in their non-IRA brokerage account. They enter $40,000 in the blue IRA Transfer box (D11) and discover that they are now $1,308 below the start of The Hump. This will give them room for a little increase in withdraws later. Let's take a closer look at the numbers in that bottom portion of the top section.

They withdrew $240,000 (D13) over a 6 year period, paid 25% in taxes and put $180,000 (D14) in their non-IRA brokerage account. If they had paid the 46.25% Hump Tax, they would have only received $129,000 (F14). They saved $51,000 by making this withdraw before retirement. OK, this is where it gets a little confusing! During retirement, their IRA income is now reduced by $7,895 (H13), their tax free income is increased by only $5,921 (I15). That seems like losing money. At the 27.75% retiree tax bracket (185% of 15%) they would need to withdraw $8,195 to get the same after tax income which is more than they lose from the IRA accounts. The best way to visualize this is to look at the total amount of after tax income (FG21). The gross income (F18) without making the pre-retirement withdraws is $115,395 and you have to pay $12,578 (H21) in taxes which results in an after tax income of $102,816. If they make the pre-retirement withdraws, their gross income drops by $1,974 to $113,421, but their taxes are reduced by $3,396 to $9,183. This results in an after tax increase of $1,422 to $104,238, and after tax income is the important number.

The green blip on the chart now shows that their gross income is now below The Hump. They now have the ability to withdraw an additional $1,308 from their IRA each year and pay only $363 in taxes. If they were in The Hump, they would have to pay $605. That is an extra $242 annually. ConclusionThe bottom line is to be aware of The Hump and plan to avoid it during retirement if you can. |

||