|

The Hump

This website was created to make suggestions on how the government

might fix the problems with the current Social Security system, but we

all know what chance we have of the government doing something logical

that might be good for the country. Re-election is their primary goal.

So, since we have to live with the current system, for a while at

least, these pages were created to help us avoid one of the biggest

problem that some of us will face, retirees paying the highest

taxation levels of any American citizen, something we call The Hump.

IRA required minimum distributions table

Tax law requires individual retirement account holders to begin taking

out at least minimum amounts, known as required minimum distributions, or

RMDs, from their accounts once they reach age 70½. Technically, that

means the IRA money must start coming out in specific increments no later

than April 1 following the year you reach that age.

The exact distribution amount changes from year to year. It is

calculated by dividing an account's year-end value by the

distribution period determined by the Internal Revenue Service.

Several years ago, the IRS revised distribution rules and the various

life expectancy tables used to make the RMD calculations. The

reformulation means that taxpayers now have to take out less. This is

welcome news to retirees who have enough income from other sources and who

want to withdraw as little as possible from their IRAs, letting the

accounts grow in value for longer.

The table shown below is the Uniform Lifetime Table, the most commonly

used of three life-expectancy charts that help retirement account holders

figure mandatory distributions. We have extended this table back to age

62 to help you plan your distributions during the early retirement

period.

To calculate the year's minimum distribution amount, take the age of the

retiree and find the corresponding distribution period. Then divide the

value of the IRA by the distribution period to find the required minimum

distribution.

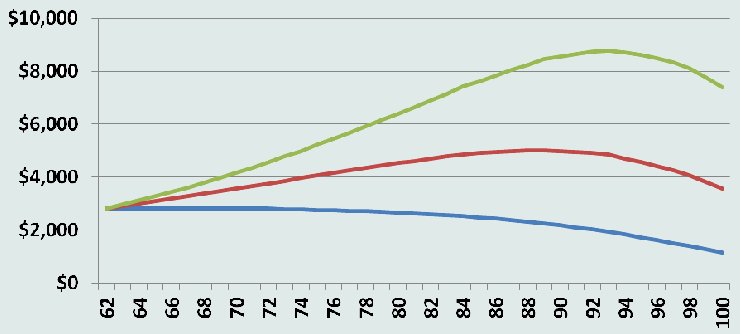

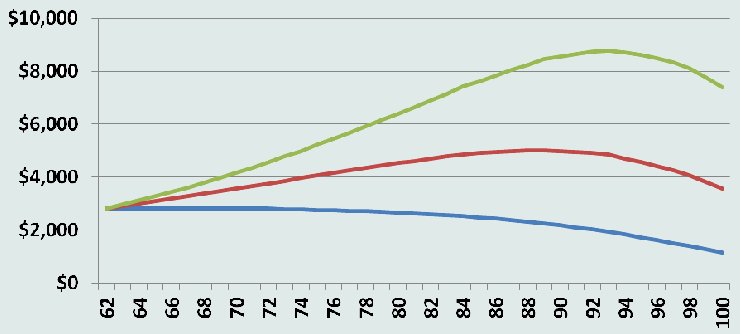

Minimum Distribution of IRA / 401K funds at no growth, 3% and 5%

growth

| Age of retiree |

Distribution period

(in years) |

|

Distribution with

zero earnings |

|

Distribution with

3% earnings |

|

Distribution with

5% earnings |

| 62 |

35.4 |

|

$100,000 |

$2,825 |

|

$100,000 |

$2,825 |

|

$100,000 |

$2,825 |

|

| 63 |

34.4 |

|

$97,175 |

$2,825 |

|

$100,090 |

$2,910 |

|

$102,034 |

$2,966 |

|

| 64 |

33.4 |

|

$94,350 |

$2,825 |

|

$100,096 |

$2,997 |

|

$104,021 |

$3,114 |

|

| 65 |

32.4 |

|

$91,525 |

$2,825 |

|

$100,012 |

$3,087 |

|

$105,952 |

$3,270 |

|

| 66 |

31.4 |

|

$88,701 |

$2,825 |

|

$99,833 |

$3,179 |

|

$107,816 |

$3,434 |

|

| 67 |

30.4 |

|

$85,876 |

$2,825 |

|

$99,553 |

$3,275 |

|

$109,602 |

$3,605 |

|

| 68 |

29.4 |

|

$83,051 |

$2,825 |

|

$99,167 |

$3,373 |

|

$111,296 |

$3,786 |

|

| 69 |

28.4 |

|

$80,226 |

$2,825 |

|

$98,668 |

$3,474 |

|

$112,886 |

$3,975 |

|

| 70 |

27.4 |

|

$77,401 |

$2,825 |

|

$98,049 |

$3,578 |

|

$114,357 |

$4,174 |

|

| 71 |

26.5 |

|

$74,576 |

$2,814 |

|

$97,305 |

$3,672 |

|

$115,692 |

$4,366 |

|

| 72 |

25.6 |

|

$71,762 |

$2,803 |

|

$96,442 |

$3,767 |

|

$116,893 |

$4,566 |

|

| 73 |

24.7 |

|

$68,959 |

$2,792 |

|

$95,455 |

$3,865 |

|

$117,943 |

$4,775 |

|

| 74 |

23.8 |

|

$66,167 |

$2,780 |

|

$94,338 |

$3,964 |

|

$118,826 |

$4,993 |

|

| 75 |

22.9 |

|

$63,387 |

$2,768 |

|

$93,086 |

$4,065 |

|

$119,525 |

$5,219 |

|

| 76 |

22.0 |

|

$60,619 |

$2,755 |

|

$91,692 |

$4,168 |

|

$120,021 |

$5,456 |

|

| 77 |

21.2 |

|

$57,863 |

$2,729 |

|

$90,149 |

$4,252 |

|

$120,294 |

$5,674 |

|

| 78 |

20.3 |

|

$55,134 |

$2,716 |

|

$88,474 |

$4,358 |

|

$120,351 |

$5,929 |

|

| 79 |

19.5 |

|

$52,418 |

$2,688 |

|

$86,639 |

$4,443 |

|

$120,143 |

$6,161 |

|

| 80 |

18.7 |

|

$49,730 |

$2,659 |

|

$84,662 |

$4,527 |

|

$119,681 |

$6,400 |

|

| 81 |

17.9 |

|

$47,071 |

$2,630 |

|

$82,539 |

$4,611 |

|

$118,945 |

$6,645 |

|

| 82 |

17.1 |

|

$44,441 |

$2,599 |

|

$80,265 |

$4,694 |

|

$117,915 |

$6,896 |

|

| 83 |

16.3 |

|

$41,842 |

$2,567 |

|

$77,839 |

$4,775 |

|

$116,571 |

$7,152 |

|

| 84 |

15.5 |

|

$39,275 |

$2,534 |

|

$75,255 |

$4,855 |

|

$114,890 |

$7,412 |

|

| 85 |

14.8 |

|

$36,741 |

$2,483 |

|

$72,512 |

$4,899 |

|

$112,852 |

$7,625 |

|

| 86 |

14.1 |

|

$34,259 |

$2,430 |

|

$69,641 |

$4,939 |

|

$110,488 |

$7,836 |

|

| 87 |

13.4 |

|

$31,829 |

$2,375 |

|

$66,643 |

$4,973 |

|

$107,784 |

$8,044 |

|

| 88 |

12.7 |

|

$29,454 |

$2,319 |

|

$63,520 |

$5,002 |

|

$104,728 |

$8,246 |

|

| 89 |

12.0 |

|

$27,135 |

$2,261 |

|

$60,274 |

$5,023 |

|

$101,306 |

$8,442 |

|

| 90 |

11.4 |

|

$24,873 |

$2,182 |

|

$56,908 |

$4,992 |

|

$97,507 |

$8,553 |

|

| 91 |

10.8 |

|

$22,691 |

$2,101 |

|

$53,474 |

$4,951 |

|

$93,401 |

$8,648 |

|

| 92 |

10.2 |

|

$20,590 |

$2,019 |

|

$49,978 |

$4,900 |

|

$88,990 |

$8,725 |

|

| 93 |

9.6 |

|

$18,572 |

$1,935 |

|

$46,431 |

$4,837 |

|

$84,279 |

$8,779 |

|

| 94 |

9.1 |

|

$16,637 |

$1,828 |

|

$42,842 |

$4,708 |

|

$79,275 |

$8,712 |

|

| 95 |

8.6 |

|

$14,809 |

$1,722 |

|

$39,278 |

$4,567 |

|

$74,092 |

$8,615 |

|

| 96 |

8.1 |

|

$13,087 |

$1,616 |

|

$35,752 |

$4,414 |

|

$68,750 |

$8,488 |

|

| 97 |

7.6 |

|

$11,471 |

$1,509 |

|

$32,279 |

$4,247 |

|

$63,276 |

$8,326 |

|

| 98 |

7.1 |

|

$9,962 |

$1,403 |

|

$28,872 |

$4,067 |

|

$57,697 |

$8,126 |

|

| 99 |

6.7 |

|

$8,559 |

$1,277 |

|

$25,550 |

$3,813 |

|

$52,050 |

$7,769 |

|

| 100 |

6.3 |

|

$7,281 |

$1,156 |

|

$22,389 |

$3,554 |

|

$46,495 |

$7,380 |

|

|

|