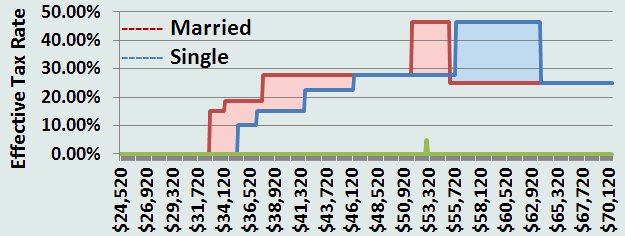

The HumpThis website was created to make suggestions on how the government might fix the problems with the current Social Security system, but we all know what chance we have of the government doing something logical that might be good for the country. Re-election is their primary goal. So, since we have to live with the current system, for a while at least, these pages were created to help us avoid one of the biggest problem that some of us will face, retirees paying the highest taxation levels of any American citizen, something we call The Hump. Who pays the highest marginal income tax rate?Is it the quarterback for your favorite NFL team? No, his top rate is only 35%. Would you believe a married couple each earning $65,000?Would you believe a single person earning $75,000?Assuming each of these individuals retires at their normal retirement age, and each has planned for the recommended retirement income of 80% of their earning before retirement, they have reached "The Hump"! They will start paying an effective marginal federal tax rate of 46.25% on any additional IRA withdraws until they "get over The Hump". If you want to know why this is called The Hump, just look at the following illustration.

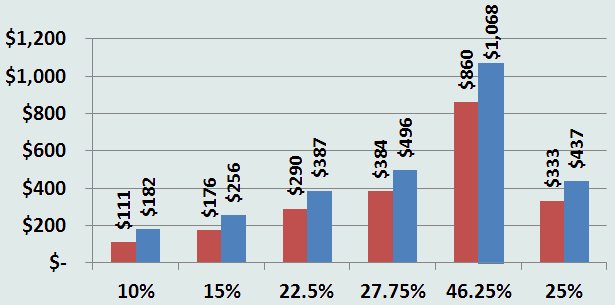

What creates The Hump?Our OASDI withholding is taken out after we pay taxes on our income, but this does not stop the government from taxing the benefits they give back a second time. The actual calculation for the basis of this tax can be a bit complicated, but basically you start by taking half of your social security income plus all of your other income. If your Social Security benefit is $27,000 and you get a pension of $10,000 and withdraw another $5,000 from your IRA, the formula to calculate the basis for your benefit taxation is $27,000 / 2 + $10,000 + $5,000 = $28,500. If you are single and this basis amount is over $25,000 then 50% of the overage becomes taxable Social Security income, again! In this case 50% of $3,500 is $1,750. When the basis amount is over $34,000, the first $9,000 is taxed at 50% and the rest is taxed at 85% until 85% of your total Social Security benefit is taxed. I'm sorry if that last paragraph was confusing, but that is normal for the way the government writes our tax laws. So, when you incur the 85% surcharge and withdraw $1,000 from your IRA, you are taxed on $1,850. If you are in the 25% federal tax bracket, you are paying 25% of 185% of what you withdraw or 46.25%. They say a picture is worth a thousand words, so we created a TaxCaster example that illustrates the 46.25% tax bracket. The Wall is Even WorseIf you take social security benefits before your full retirement age, and you earn income in excess of the $14,160 annual earnings limit, your social security benefit will be reduced. Keep in mind, pension, investment, and 401K income does not count toward the annual earnings limit; the only income that counts is earned income - the money you earn from working. It includes wages, salaries, tips and net earnings from self employment income. When you combine this reduction in benefits with the affects of the hump, you hit "The Wall", a situation where you can actually pay more than 100% in taxes and penalties. You are literally paying the government for the privilege of working! Thankfully, this ridiculous taxation policy ends when you reach your full retirement age. The marriage penaltyThe pink and blue shaded areas in the illustration above represent the marriage penalty. Married couples have more of their Social Security benefits taxed earlier and therefore pay higher taxes than an unmarried couple. The Cost of Money when you are In The HumpThe real problem with The Hump is the cost of money when you are in it. If you are lucky enough to be in a state that has no income tax, you will still have to withdraw $1,860 from your IRA to have $1,000 after paying your federal tax. The average state income tax is 5.397%. Your withdraw in the average state has to be $2,068 so you can give more than half of the money to the state and federal government, and this does not include any county, city, or other income taxes.

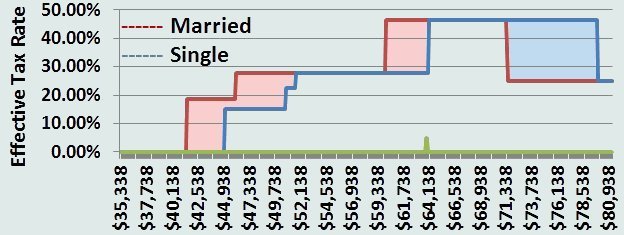

The more you make the worse it gets!The size of The Hump depends on the size of your Social Security check. If you earn more money or delay retirement to get a bigger benefit check, the size of The Hump can increase dramatically.

The Hump for the single person in this example covers about $15,700 of gross income. The federal tax alone would be $7,261, leaving you with only $8,439 of spendable cash, and if you are paying the average state income tax, your spendable cash would be further reduced to only $7,591. What To DoThe most important thing is to be aware of The Hump and to know where your income level will be in relation to it. Before RetirementThe Social Security Administration starts sending you statement at the age of 50. This statement will tell you your expected benefit at full retirement age, age 62, and age 70. If you have a pension, check to find out the expected pension amount at the age you wish to retire. Finally, look at all of your 401K and IRA statements. Try to estimate the total amount that you will have in these accounts at your expected retirement age. The government will force you to start making withdraws from your retirement account when you reach age 70. Determine how much you plan to withdraw each year and make sure it is at least the governmentís minimum. Use all of these numbers to create an estimated tax return and see how close you are to the 25% tax bracket. Turbo tax has an excellent on-line tax estimator called Tax Caster. If you find yourself close or within the 25% bracket, consider opening a savings account outside of your IRA. The money you withdraw from a regular savings or brokerage account does not count toward the basis calculation.

During RetirementThe most important thing during retirement is to do your taxes in early December. Limit your withdraws for the rest of the year so you donít enter The Hump. If you are a few thousand dollars away from The Hump, consider making an extra withdraw at the 27.75% (15% of 185%) level this year just in case you need extra money next year. Letís say you are the individual in the previous chart and you want to take a vacation that will cost you an extra $7,500. You will have to withdraw most if not all of the $15,700 that is in The Hump to get the money. But now you are over The Hump. Even at the average state tax rate you only have to withdraw $10,777 to get another $7,500 in cash. That is a savings of almost $5,000, so consider making a large withdraw and place that extra cash in a savings account. What if you were planning that trip for February or March and you were $6,000 under The Hump. You could take half of the money out in December and the other half out in January and ever reach The Hump. A final wordThe most disturbing thing about this page is that it is not talking about "The Rich" as the government keeps referring to them, those making $250,000 or more. The examples are not even about what most of us refer to as rich, those with "Six Figure Incomes". No, this page talks about people who make $65,000, $75,000 and $80,000 a year. Bottom line is that there are more people with those income levels, so they are a better source of income for the government. They talk tough about the rich but target the middle class. |

||||||||||||||||||||||||||||||||||||||||||||