The HumpThis website was created to make suggestions on how the government might fix the problems with the current Social Security system, but we all know what chance we have of the government doing something logical that might be good for the country. Re-election is their primary goal. So, since we have to live with the current system, for a while at least, these pages were created to help us avoid one of the biggest problem that some of us will face, retirees paying the highest taxation levels of any American citizen, something we call The Hump. The marriage penalty

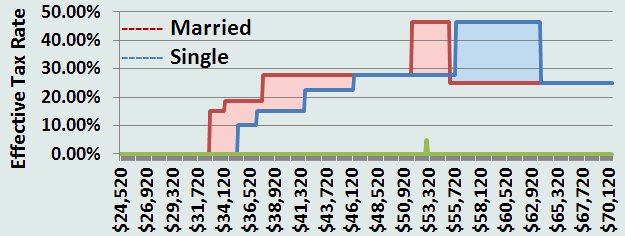

The pink and blue shaded areas in the illustration above represent the marriage penalty. The penalty exists because the breakpoints for the taxation of a married coupleís benefits, $32,000 and $44,000, are far less than two single people who are living together, $25,000 and $34,000. The government is penalizing them for being married.

Itís not just that the married couple is being taxed on more of their benefits, but that taxation is also pushing them into higher tax brackets. Letís look at the chart again.

The married couple starts paying taxes at a gross per capita income of $32,920. Their 50% benefit taxation started at $28,320, so they start paying taxes at the 15% effective tax rate, not the 10% rate, and when they hit the 85% benefit taxation rate at a gross income of $34,320 their effective tax rate jumps to 18.5%. An unmarried person doesnít start paying taxes until a gross income of $35,200 and since they still do not qualify for any taxation of their benefits, they start at the 10% level. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||