The HumpThis website was created to make suggestions on how the government might fix the problems with the current Social Security system, but we all know what chance we have of the government doing something logical that might be good for the country. Re-election is their primary goal. So, since we have to live with the current system, for a while at least, these pages were created to help us avoid one of the biggest problem that some of us will face, retirees paying the highest taxation levels of any American citizen, something we call The Hump. The WallAs if the hump's effective tax rate of 46.25% wasn't bad enough;

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Line | Earned Income |

SS Benefit |

85% of Benefit |

Taxability Basis |

Taxable SS |

Taxable Income |

Taxes Due |

After Tax |

-FICA -Medi |

Effective Tax Rate |

| 1 | $100.00 | $0.00 | $0.00 | $100.00 | $85.00 | $185.00 | $27.7500 | $72.2500 | $64.6000 | 35.4000% |

| 2 | $100.00 | -$50.00 | -$42.50 | $75.00 | $63.75 | $163.75 | $24.5625 | $25.4375 | $17.7875 | 82.2125% |

| 3 | $100.00 | -$50.00 | -$42.50 | $75.00 | $63.75 | $163.75 | $40.9375 | $9.0625 | $1.4125 | 98.5875% |

| 4 | $100.00 | -$50.00 | -$42.50 | $75.00 | -$42.50 | $57.50 | $14.3750 | $35.6250 | $27.9750 | 72.0250% |

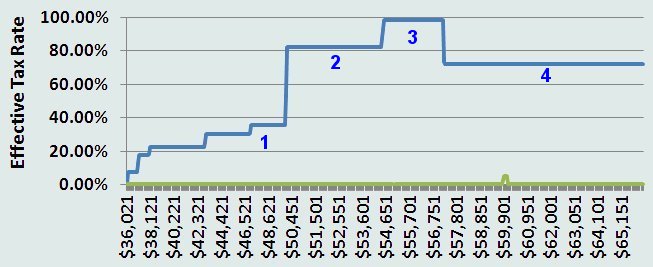

Line 1 represents the situation where your earned income is less than $14,160. It assumes that you are in the 85% surcharge bracket and the 15% tax bracket. Your taxes due are $27.75 on each $100 of earning. When you also include FICA and Medicare, your after tax income is $64.60.

Line 2, your earned income crosses over the $14,160 limit. Your benefit is now reduced by $50 for each $100 you earn. Since this also reduces your taxability basis, your taxes due are also reduced to $24.56. But, since your income was also reduced by $50 your after tax, after FICA and Medicare income is only $17.79.

Line 3 crosses into the 25% federal tax bracket. You've hit the wall! Your taxes due jumps to $40.94, so when you include the reduction in Social Security, FICA and Medicare, your income is only $1.41 for each $100 of additional earnings. As mentioned before, if you include state and local taxes, your total tax rate is over 100% and you are literally paying the government for the privilege of working!

Line 4, you have now scaled the wall; you have reached the maximum taxation of your Social Security Benefit. In fact, since your Benefit is being reduced $50 for each $100 you earn, your maximum taxable social security is also being reduced by $42.50. This greatly reduces your taxes due, but you are still paying the $50 benefit reduction plus FICA and Medicare, so your after tax earning is only $27.98 for each $100 of earnings.